Blog

The Way To Construction Your Chart Of Accounts

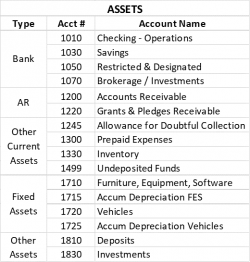

A chart of accounts is the submitting cupboard on the heart of your accounting system. Businesses use the COA’s list of account names to group transactions into completely different buckets. Each account often has an account quantity and a description, too. Groups of numbers are assigned to every of the five primary classes, while blank numbers are left at the end to permit for added accounts to be added in the future.

Balance sheet accounts like assets, liabilities, and shareholder’s fairness are shown first, after which come income statement accounts like revenue and expenses, within the order they appear on your monetary statements. You may also want to break down your business’ COA according to product line, company division, or enterprise function, depending on your distinctive needs. The chart of accounts serves as the foundational framework used to generate the financial statements for a enterprise. These monetary statements, which include the balance sheet, earnings assertion, and money move assertion, are the principal stories an organization relies on for making informed decisions.

This is especially true for expense accounts, which are critical to claiming tax deductions. Meals for company-wide occasions, like a vacation party, qualify for a one hundred pc deduction. For instance, lots of businesses have a “meals” subaccount under the principle expenses account.

For instance, assume your cash account is and your accounts receivable account is 1-002, now you wish to add a petty cash account. Properly, this must be listed between the cash and accounts receivable within the chart, but there isn’t a quantity in between them. Although most accounting software program packages like Quickbooks include a normal or default list of accounts, bookkeepers can arrange and customize their account construction to fit their enterprise and industry. The chart of accounts is a listing of each account in the basic ledger of an accounting system. Not Like a trial steadiness that solely lists accounts that are active or have balances at the end of the interval, the chart lists all of the accounts within the system. It doesn’t embody another details about each account like balances, debits, and credit like a trial stability does.

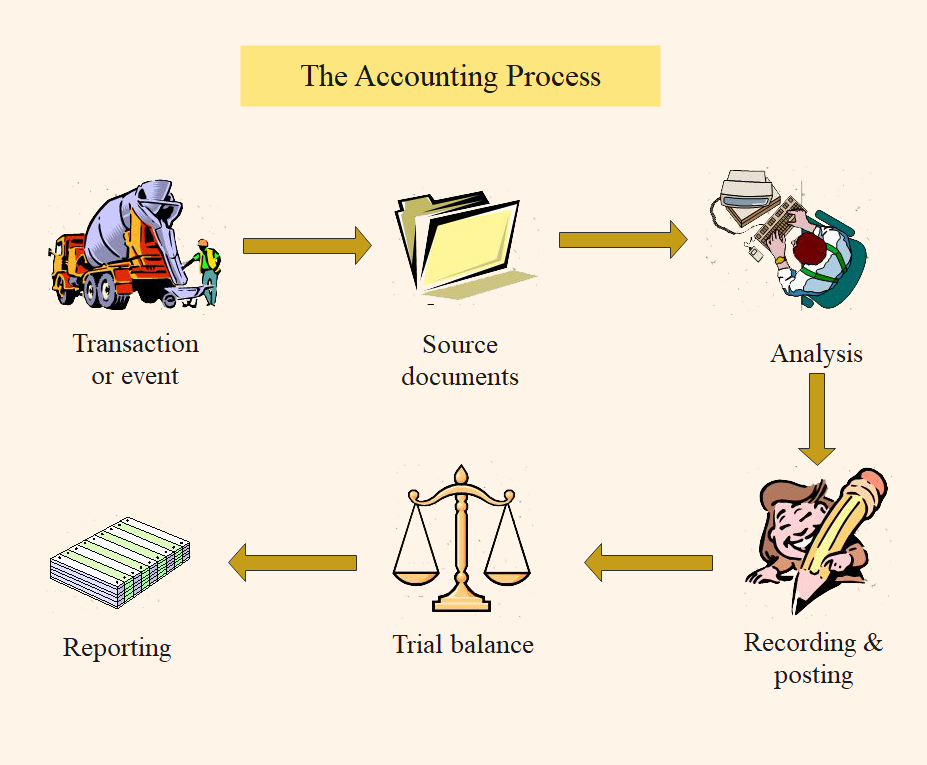

You won’t be able to save the accounting entry so long as the quantities do not stability. When you want to record a business transaction, it ought to be recorded in at least two accounts – one in debit and the other in credit. This technique is called double-entry bookkeeping and is designed to be self-checking. Most folks choose to make use of the BAS chart of accounts because it makes it easier to submit information and tax returns. As A Substitute, you can choose to create your individual accounts with numbers and names and compile them right into a chart of accounts that suits your business.If you keep accounts manually, they don’t have to have a number.

Well-liked Providers

- By often reviewing categorized monetary knowledge, especially working bills, you can identify areas where costs could be lowered or resources higher allotted.

- The steadiness sheet accounts comprise assets, liabilities, and shareholders fairness, and the accounts are broken down additional into various subcategories.

- The use of the French GAAP chart of accounts structure (but not the detailed accounts) is stated in French law.

- By analyzing the nature of the transaction or instrument, consulting accounting standards, and presumably creating new accounts or sub-accounts to accurately mirror them.

- Initially, an organization needs to resolve the construction of its COA, the account types and the numbering sample.

Equity accounts will vary significantly primarily based on the structure of the business. For occasion, whether or not it’s a corporation, partnership, or sole proprietorship. Expenses check with the costs you incur while operating your small business.

Common Number Ranges

Nonetheless, a profit and loss (P&L) statement overviews revenues and expenses. The chart of accounts streamlines numerous asset accounts by organizing them into line objects so that you simply can monitor multiple parts simply. There are many different ways to construction a chart of accounts, however the essential thing to recollect is that simplicity is vital.

A chart of accounts is a software that lists all the accounts in the general ledger with distinctive numbering to help find them within the related accounting guide. Stakeholders can discuss with the COA and balance sheet, and revenue assertion to seek out the supply of expense and earnings. As A Result Of the chart of accounts is a listing of every account discovered within the business’s accounting system, it may possibly present perception into all the totally different financial transactions that take place throughout the company.

Income Statement Accounts – These are the income accounts for the enterprise. The measurement and sort of sales will determine the account codes you may want. A few examples are gross sales https://www.simple-accounting.org/ of products, consultancy, components, assist, and interest obtained. Bookkeeping software program is extra versatile and often saves businesses time on the accounts. Some packages ask for the business’s industry when establishing the software program. Every account lets you monitor transactions within the software and produce monetary statements, together with Steadiness Sheet and Revenue assertion (Profit and Loss).

When calculating your business’s internet earnings, you’ll subtract bills from revenue. The numbering system varieties the inspiration of your chart of accounts, providing a structured methodology to prepare financial data. It’s designed to be intuitive and scalable, permitting for future progress without requiring a complete redesign.